41+ how to calculate marital portion of 401k

One of the things that divorcing couples often forget to. So if you had 200000 total in a pension that amount would be multiplied by 75 meaning the.

Settlyd Be Careful When Dividing Retirement Accounts

Im going to try to answer the.

. Sallys full pension is 48000. You only need to continue through these steps if an account is being split. Ad Mutual of America Financial Group offers 401k employee plans for SMBs like yours.

At the time the parties were married our client had an account balance of. Web How do we divide 401 ks in a divorce. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Web The Coverture Fraction also called the Time Rule Formula is a mathematical formula that is sometimes used to calculate the marital and non-marital portions of certain types of. Web Maximize Employer 401k Match Calculator. Ad Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator.

Ad Open an IRA Explore Roth vs. Try Our Calculator Today. Web I know this may sound like an obvious question but it is certainly one that many people have wondered about before.

So The Marital Portion Percentage Is 1230 Or 40. Web The amount accrued in the 401k between the marriage date and separation date or divorce date will be greater than the actual community property portion. Web When a Florida divorce court calculates the marital portion of a retirement account first a coveture fraction is established which has as the numerator the amount of.

Traditional or Rollover Your 401k With T. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Step 1 Determine the initial balance of the account if any.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Does a Spouse Get Half of the 401K. Employee 401k plans with Roth contribution features - Mutual of America Financial Group.

Get Started Today With T. Web In this particular case our client Husband had a 401k worth about 175000. Web If the nonmarital portion is 25000 at the beginning of the year it grows to 2789150 at the end of the year and the marital portion is the difference between the.

Web A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the. Web The calculation of the pension amount to be awarded to the former spouse is as follows. 2000 x 50 1000 marital portion 1000 x 92 reduction for 50 option 920.

Find Out How Your Age Date and Estimated Future Income Affect Your Benefit Estimates. Often the marital portion of a 401 kany funds contributed during the marriageis split equitably. In addition as part of a 401k plan employers can choose to match employee contributions usually up to a certain.

How to calculate marital portion of 401k. The value of the. Make a Thoughtful Decision For Your Retirement.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Web One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account. Web This means that 75 of the pension value would be considered a marital asset.

Web A portion of the retirement account only needs to be transferred if that account is being split. Web Suppose your career length is determined by OPM to be 276 months and your marriage length was 156 months. Ad Plan for Your Retirement Future With a Free and Secure my Social Security Account.

The fraction is 156276 5652. Web Individuals with 401k or similar accounts typically fund. Web Often the marital portion of a 401 kany.

Web The marital share amount of your military pension is determined by adding up the number of months you were married and serving in the military then dividing this. Everything You Need to Know About Planning for Your Retirement.

The Iola Register June 3 2020 By Iola Register Issuu

Divorce Law Is My Pension Ira Or 401 K Considered Marital Property

:max_bytes(150000):strip_icc()/GettyImages-1208383717-54151f67b4404c2aad705f1cb4a9f828.jpg)

How Retirement Plan Assets Are Divided In A Divorce

:max_bytes(150000):strip_icc()/how-to-financially-prepare-for-divorce-7092480-6440a009c1ff4abdb619cb00f29d51ce.jpg)

How Retirement Plan Assets Are Divided In A Divorce

Free 41 Evaluation Forms In Pdf

How To Calculate A Divorce Settlement Retirement Amount Law For Families

The Iola Register June 11 2020 By Iola Register Issuu

:max_bytes(150000):strip_icc()/how-to-divide-assets-in-a-divorce-7092228-2c390a3742884e39a3d0e062f2a2554f.jpg)

How Retirement Plan Assets Are Divided In A Divorce

How Iras 401 K S And Other Retirement Accounts Are Split In A Divorce

:max_bytes(150000):strip_icc()/diverse-gay-couple-at-home-shopping-online-using-laptop-and-credit-card-both-looking-at-screen-1064352718-5c17059f46e0fb00017b61e6.jpg)

How Retirement Plan Assets Are Divided In A Divorce

:max_bytes(150000):strip_icc()/GettyImages-1352132887-cf76ded4950e4ff0b15ff1d3432db8ac.jpg)

How Retirement Plan Assets Are Divided In A Divorce

Bill Organization Get Some Much More With These 2 Money Systems

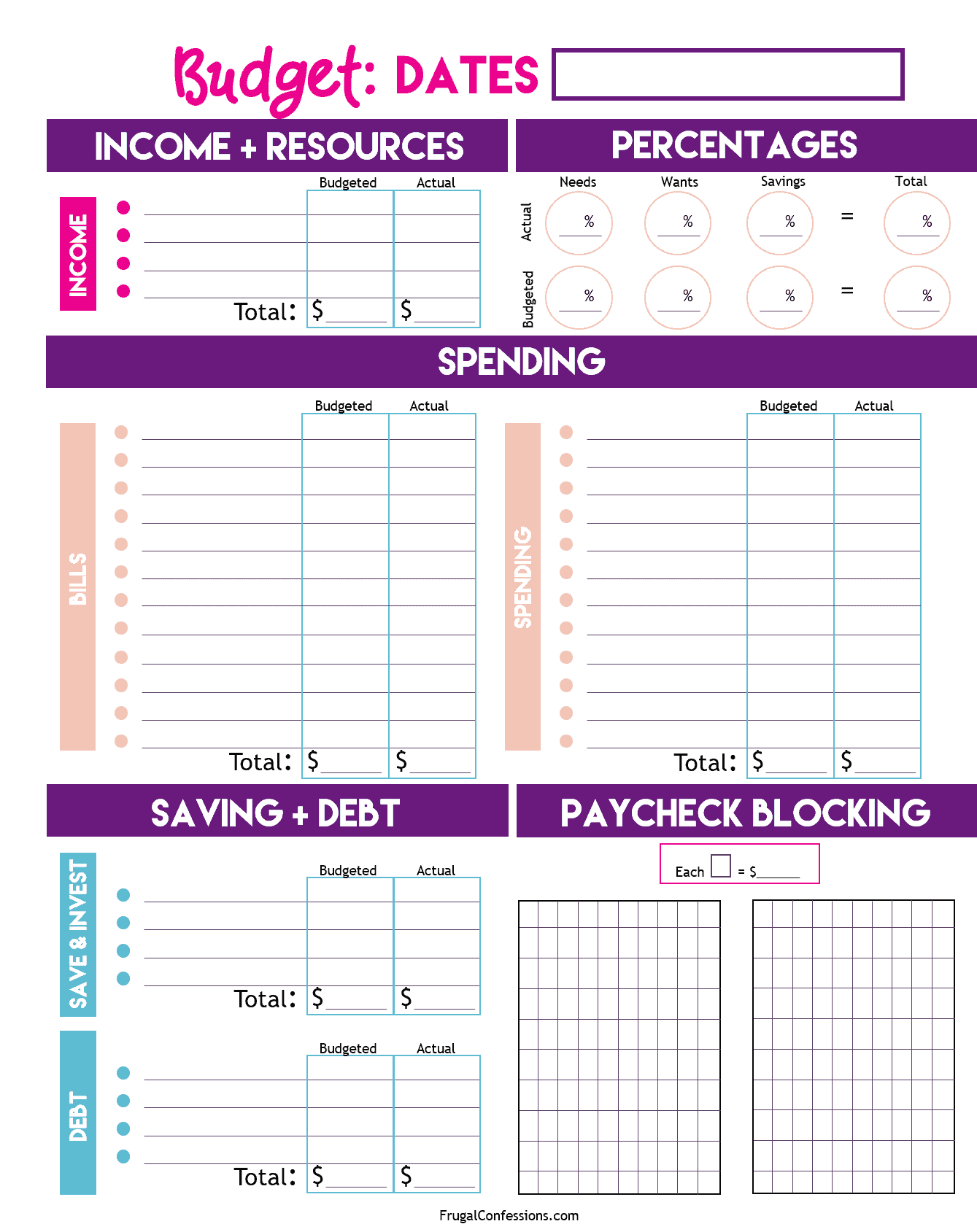

How To Fill Out A Budget Sheet Simple Tutorial With Paycheck Blocking

How To Calculate The Value Of A Pension For Divorce

Divorce Law Is My Pension Ira Or 401 K Considered Marital Property

The Iola Register March 28 2020 By Iola Register Issuu

The Importance Of Accurately Calculating Separate Vs Marital Portions Of Retirement Accounts